Are you tired of rummaging through stacks of receipts every tax season? Say goodbye to the chaos and hello to organization with Receiptify! This innovative tool is here to revolutionize how you manage your expenses. Get ready to streamline your financial record-keeping like never before. Let’s dive into the world of Receiptify and discover how it can simplify your life.

What is Receiptify?

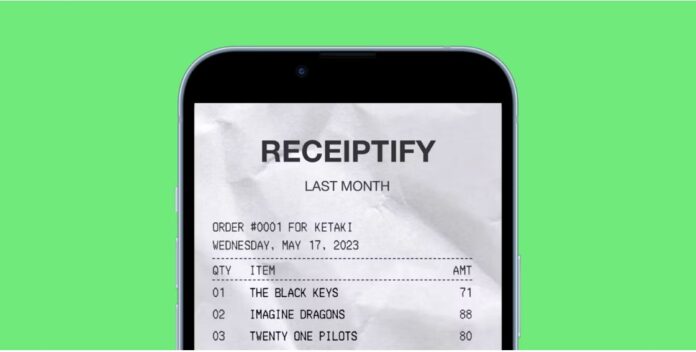

Receiptify is a game-changer when it comes to organizing your receipts. It’s a digital platform designed to help you effortlessly manage and track your expenses. No more lost or faded paper receipts cluttering up your desk – Receiptify stores all your data securely in one convenient place.

With Receiptify, you can say goodbye to manual entry and tedious paperwork. Simply snap a photo of your receipt using the app, and let Receiptify do the rest. The software uses advanced technology to extract key information like date, amount, and vendor automatically.

Not only does Receiptify save you time and hassle, but it also provides valuable insights into your spending habits. By categorizing expenses and generating detailed reports, you’ll gain a clear picture of where your money is going each month. Say hello to financial clarity with Receiptify!

Benefits of Organizing Your Receipts with Receiptify

Organizing your receipts with Receiptify offers a range of benefits that can streamline your financial record-keeping. By using this handy tool, you can say goodbye to the hassle of sifting through piles of paper receipts or trying to remember where you spent your money.

One key advantage is the ability to easily track and categorize expenses. With Receiptify, you can quickly assign tags and labels to each receipt, making it simple to see where your money is going at a glance. This feature is especially helpful for budgeting purposes and tracking spending trends over time.

Another benefit of using Receiptify is the convenience factor. Instead of manually inputting data or dealing with clunky spreadsheets, you can simply snap a photo of your receipt and let the app do the rest. This saves time and reduces errors in recording information.

Organizing your receipts with Receiptify not only helps keep your finances in order but also provides valuable insights into your spending habits.

How to Get Started with Receiptify

Getting started with Receiptify is a breeze. First off, head over to their website and sign up for an account. Simply enter your details and create a secure login.

Once you’re all set up, it’s time to start organizing those pesky receipts. Grab your phone or scanner and begin uploading your receipts into the system. Receiptify makes this process seamless by allowing you to easily scan and upload multiple receipts at once.

Next, take advantage of Receiptify’s categorization features. Tag each expense with relevant categories to keep everything organized efficiently. Whether it’s groceries, utilities, or office supplies, sorting expenses has never been easier.

As you continue using Receiptify, track your expenses diligently. The platform offers robust reporting capabilities that allow you to analyze spending patterns and make informed financial decisions based on real data.

With these simple steps in mind, you’ll be well on your way to maximizing the benefits of using Receiptify for efficient receipt management.

Step-by-Step Guide on Using Receiptify

Signing up for an account on Receiptify is a breeze. Simply head to their website and click on the sign-up button. Fill in your details, create a secure password, and you’re good to go!

Once you have your account set up, it’s time to start scanning and uploading your receipts. You can do this easily by using the mobile app or uploading them directly from your computer.

Categorizing and tagging expenses is crucial for efficient organization. Take a few moments after each upload to assign categories like groceries, travel, or utilities. Tags can further help you track specific spending patterns.

Tracking expenses and creating reports is where Receiptify shines. With just a few clicks, you can generate detailed reports that give you insights into your spending habits over time.

Get started with Receiptify today and take control of your finances effortlessly!

A. Signing Up for an Account

Are you ready to take control of your receipts and expenses effortlessly? Signing up for an account with Receiptify is the first step towards a more organized financial life. The process is quick and easy, requiring just a few simple steps.

To begin, head over to the Receiptify website or download the app on your mobile device. Look for the “Sign Up” button and click on it to get started. You’ll be prompted to enter some basic information like your email address, name, and create a secure password.

Once you’ve filled in all the necessary details, verify your email address by clicking on the confirmation link sent to you. This step ensures that your account is properly activated and ready for use. Now, you’re all set to start digitizing and managing your receipts hassle-free!

B. Scanning and Uploading Receipts

Now that you’ve set up your Receiptify account, it’s time to dive into the nitty-gritty of managing your receipts. Scanning and uploading your receipts couldn’t be easier with this user-friendly platform. Simply grab your phone or scanner, snap a picture of your receipt, and watch as Receiptify magically digitizes it for you.

Uploading receipts on-the-go has never been more convenient – whether you’re at a business lunch or shopping for office supplies, just capture the receipt right then and there. No more scrambling to find crumpled paper slips in your wallet; all it takes is a few clicks to upload them seamlessly onto Receiptify.

By digitizing your receipts, not only are you decluttering physical paperwork but also ensuring that all expenses are recorded accurately. Plus, having easy access to all uploaded receipts means no more frantic searching when tax season rolls around. Stay organized effortlessly with Receiptify’s scanning and uploading feature!

C. Categorizing and Tagging Expenses

Once you’ve scanned and uploaded your receipts to Receiptify, the next step is categorizing and tagging your expenses. This crucial step helps you organize your spending habits effectively.

Take a moment to review each receipt and assign it to the appropriate category, such as groceries, utilities, or entertainment. By categorizing your expenses accurately, you’ll have a clear overview of where your money is going.

Additionally, use tags to further refine your expense tracking. Tags allow you to group similar expenses together for better analysis. For example, tag all business-related receipts with “work” or mark personal purchases with “shopping.”

By meticulously categorizing and tagging your expenses in Receiptify, you can gain valuable insights into your financial patterns and make informed decisions moving forward.

D. Tracking Expenses and Creating Reports

Once you have organized and categorized your expenses using Receiptify, it’s time to track them efficiently. The platform provides a user-friendly interface where you can easily monitor your spending patterns. By regularly updating your expenses, you can stay on top of your budget and financial goals.

Creating reports with Receiptify is a breeze. You can generate detailed reports that showcase your expenditure breakdown in various categories. Whether it’s for personal finance management or business purposes, these reports are invaluable tools for making informed decisions.

With just a few clicks, you can access insightful insights into where your money is going and identify areas where you may need to cut back or reallocate funds. Tracking expenses and creating reports has never been easier than with Receiptify at your fingertips!

Tips for Maximizing the Use of Receiptify

Looking to get the most out of Receiptify? Here are some handy tips to optimize your experience with this innovative receipt organization tool.

Consider setting up regular reminders or alerts to prompt you to upload receipts promptly. This will help you stay on top of your expenses and ensure nothing slips through the cracks.

Take advantage of Receiptify’s categorization and tagging features. By accurately labeling your expenses, you’ll be able to track spending habits more effectively and generate insightful reports.

Additionally, make use of Receiptify’s search function to quickly locate specific receipts when needed. Keywords or tags can streamline the process and save you valuable time searching through a sea of documents.

Explore Receiptify’s integration options with other financial tools or software for seamless data transfer. This can enhance efficiency and provide a comprehensive overview of your financial landscape.

Alternatives to Receiptify

While Receiptify offers a user-friendly and efficient way to organize receipts and track expenses, there are also alternative tools available for managing finances. Some popular alternatives to Receiptify include Expensify, Shoeboxed, and Wave Receipts. Each of these platforms has its own unique features and benefits that may better suit individual preferences or business needs. It’s essential to explore different options to find the best fit for your receipt organization and expense tracking requirements. Experiment with various tools to see which one aligns most closely with your workflow and helps streamline your financial management processes effectively. Choosing the right tool will make staying on top of your expenses a breeze!